In an age marked by the rapid advancement of digital technology, Bitcoin has emerged as a groundbreaking innovation that has revolutionised the financial landscape. As the world's first decentralized digital currency, Bitcoin operates without the oversight of a central bank or a single controlling authority. Its peer-to-peer nature ensures that transactions are carried out directly between parties, eliminating the need for intermediaries and the associated fees. With its open-source software, anyone can participate in the Bitcoin ecosystem, democratising access to the world of cryptocurrency.

A few things you should know

- Bitcoin is a digital form of cryptocurrency without any central bank or a single person controlling it.

- It is peer-to-peer which means, there is no middle man whenever any transaction is being done.

- It is an open-source software and any one can participate in bitcoin ecosystem.

- Bitcoin transactions can be made from any time, anywhere in the world with just a computer or a bitcoin wallet and internet.

The root problem with conventional currency is all the trust that's required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts. - Bitcoin open source implementation of P2P currency

Bitcoin supply is limited to 21 million, which makes it a store of value for some investors. Also, a lot of people don’t spend their bitcoins, instead chose to hold them for the long-term (also known as hodling).

How does bitcoin work?

Bitcoin works on blockchain technology, which is defined as an open ledger system which broadcasts all the transactions and everyone can see those transactions, but only written once to the blockchain when the transaction is made.

Suppose Alice pays one bitcoin to Bob and now Bob pays half a bitcoin to John. All these transactions can be seen on blockchain. There isn’t a centralized bank or institution to process transfers. In order to add new information, the Bitcoin blockchain uses a special mechanism called mining. It is through this process that new blocks of transactions are recorded in the blockchain.

Who created Bitcoin?

Well, nobody really knows who created bitcoin. It was created by someone who used the pseudonym Satoshi Nakamoto, but we don’t know anything about their identity. Satoshi could be one person or a group of developers anywhere in the world.

Satoshi published the Bitcoin white paper as well as the software. However, the mysterious creator disappeared in 2010.

Bitcoin creation aka mining

The science behind bitcoin creation is, what is called bitcoin mining, which is the generation of freshly mined bitcoins through the use of GPU miners, Asic miners or cloud mining. By mining, participants add blocks to the blockchain. To do so, they must dedicate computing power to solving a cryptographic puzzle. As an incentive, there is a reward available to whoever proposes a valid block. Block generation is expensive, but block validation is cheap. If someone tries to cheat the system to validate the invalidated block, the system rejects it, and the miner will be unable to recoup the mining costs.

The reward is the block reward, which is made of two components, fees attached to the transactions and the block subsidy. The block subsidy is the only source of “fresh” bitcoins. With every block mined, it adds a set amount of coins to the total supply. It takes approximately ten minutes to find a new block. Blocks aren’t always found exactly ten minutes after the previous one – the time taken merely fluctuates around this target.

How can I buy Bitcoin?

To buy bitcoins, you can use your credit/debit card and even use your bank accounts on some websites. I have listed few good exchanges below where you could buy bitcoins :

What can I buy with Bitcoin?

Well, what about a Lamborghini.

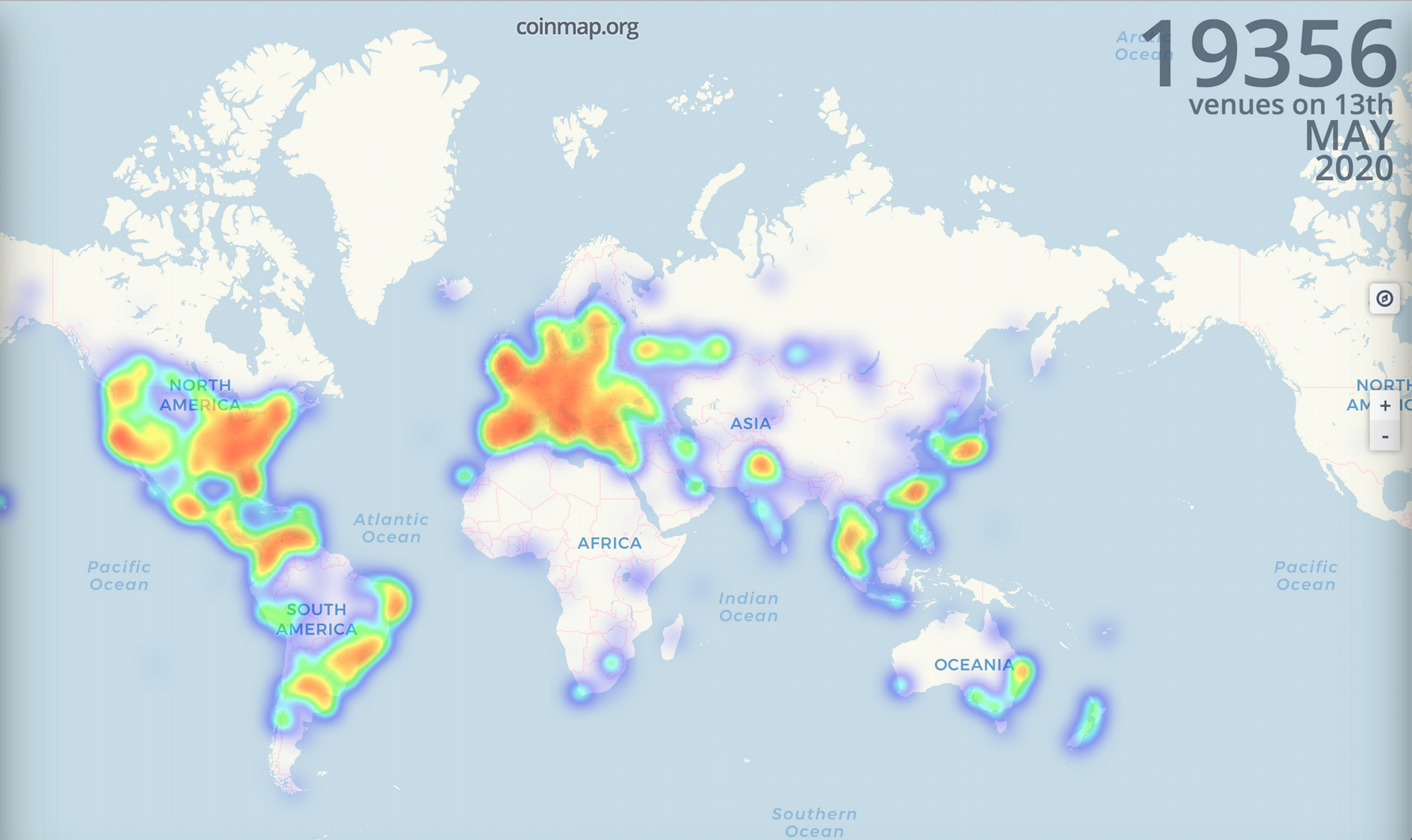

Other than that you could buy almost anything with bitcoin, pay your bills, do online shopping and much more. useBitcoins is a platform with almost 5,000 listed businesses that accept BTC.

You could use it for travel, video games, food, charity, taxi, gift cards and what not

Bitcoin's Unique Features

Bitcoin boasts several unique features that set it apart from traditional fiat currencies. Unlike conventional currencies, Bitcoin transactions can be initiated at any time from any location globally, requiring only a computer or a Bitcoin wallet and an internet connection. This inherent accessibility underscores its potential to reach individuals who are otherwise excluded from the traditional banking system.

One of Bitcoin's most significant attributes is its limited supply. With a maximum cap of 21 million coins, Bitcoin is designed to be a deflationary currency. This scarcity lends itself to becoming a store of value, attracting investors who seek to hedge against inflation and market uncertainties. This has led to the phenomenon of "hodling," where a considerable number of individuals choose to hold onto their Bitcoin rather than engage in frequent transactions.

The Central Problem of Trust

A fundamental issue faced by conventional currencies is the trust required to sustain their functionality. Central banks must be relied upon not to devalue the currency, yet history has shown numerous instances of such trust being breached. Additionally, banks, entrusted with safeguarding our funds and conducting electronic transfers, often lend out money in waves of credit, holding only a fraction in reserve. This exposes the system to vulnerabilities, including credit bubbles and potential bank runs. Moreover, individuals must trust financial institutions to protect their privacy and prevent identity theft. In contrast, Bitcoin's open-source implementation of peer-to-peer currency offers a solution that minimizes reliance on centralized entities, placing greater control and responsibility in the hands of its users.

Understanding the Mechanics of Bitcoin

At the core of Bitcoin's operation lies blockchain technology. A blockchain is an open ledger system that transparently records all transactions. While all transactions are visible to everyone, they are written onto the blockchain only once they are confirmed as valid transactions. Imagine Alice sending one Bitcoin to Bob, who subsequently transfers half a Bitcoin to John. These transactions are visible to all participants on the blockchain, but there is no central bank overseeing the process. Instead, a process called mining is used to validate and add new transactions to the blockchain.

Mining, the process by which new Bitcoins are generated, involves solving complex cryptographic puzzles using specialized hardware like GPU miners, ASIC miners, or cloud mining services. This process requires participants to dedicate significant computing power to maintain the security and integrity of the network. In return, miners are rewarded with newly created Bitcoins, comprising transaction fees and a block subsidy. This mechanism ensures the steady addition of new blocks to the blockchain and the regulated release of fresh Bitcoins into circulation.

The Enigmatic Creator and Bitcoin's Genesis

The enigma surrounding Bitcoin extends to its creator. Introduced in 2008 by an individual or group operating under the pseudonym Satoshi Nakamoto, the true identity of this visionary figure remains unknown. The Bitcoin white paper and the software were published by Satoshi Nakamoto, who then vanished from the scene in 2010. The mystery of Satoshi's identity has fueled speculation and curiosity, as their groundbreaking invention has reshaped the world of finance and technology.

Investing in Bitcoin: Mining and Beyond

Bitcoin's creation through mining has inspired a thriving ecosystem that encompasses various methods of acquiring the digital currency. Mining involves expending computational resources to validate transactions and secure the network. Miners compete to solve complex mathematical puzzles, with the first successful miner adding a new block to the blockchain and receiving the associated block reward. This reward comprises transaction fees paid by users and the block subsidy, which introduces new Bitcoins into circulation.

However, investing in Bitcoin extends beyond mining. Individuals can buy Bitcoins using their credit or debit cards, as well as bank accounts, on various exchanges. Notable exchanges like Binance, Coinbase, and Iconomi provide platforms for users to purchase and trade Bitcoin. This accessibility has contributed to the widespread adoption of Bitcoin as a digital asset with investment potential.

The Expanding Utility of Bitcoin

The narrative surrounding Bitcoin has evolved from being solely a store of value to encompassing a diverse range of applications. While some investors choose to hold onto their Bitcoins as a hedge against traditional financial systems, others recognize its utility as a medium of exchange. Bitcoin's acceptance as a method of payment is growing steadily, with a multitude of retailers, online platforms, and service providers accepting Bitcoin for goods and services. From luxury items like Lamborghinis to everyday expenses like bills and online shopping, the possibilities for utilizing Bitcoin are expanding.

Moreover, Bitcoin's volatility has given rise to an active trading environment. Cryptocurrency exchanges such as Binance, Coinbase, Bitmex, Bybit, and Deribit facilitate the buying and selling of Bitcoin against other cryptocurrencies. Unlike traditional markets, crypto trading operates 24/7, providing continuous opportunities for profit. Traders leverage Bitcoin's price fluctuations to their advantage, engaging in technical analysis and employing various strategies to navigate the dynamic market landscape.

The Future of Bitcoin and Beyond

Bitcoin's ascent from obscurity to mainstream recognition is a testament to its transformative potential. As technology continues to advance, Bitcoin's role in reshaping the financial sector is likely to expand further. It has paved the way for the development of numerous other cryptocurrencies and blockchain-based projects, sparking discussions about the future of money, privacy, decentralization, and more.

In conclusion, Bitcoin's emergence as a decentralized digital currency has challenged traditional financial systems and reshaped the way we perceive value and transactions. With its decentralized nature, limited supply, and groundbreaking blockchain technology, Bitcoin has garnered a diverse array of use cases, from investment to everyday transactions. While the identity of its creator remains shrouded in mystery, Bitcoin's impact on the world of finance and technology is undeniable. As we navigate this ever-evolving landscape, Bitcoin stands as a beacon of innovation and a symbol of the possibilities that arise when technology and finance converge.

Subscribe to Plezna

Crypto knowledge delivered, right to your inbox